At Becketts, we talk to clients about retirement all the time, usually aiming to answer “when?”, but are people ready for retirement? How is time going to be filled once work is over and what are they going to do with it?

Once the excitement of “no more work” subsides, how do you change your mind set and approach to time? As all your time is now yours and there’s no alarm on Monday morning!

We spoke to some of our recently retired clients to find out how they were coping with the change in pace to their lives and what had surprised them about retirement and any unforeseen challenges.

Here are their top tips:

1. Retirement is not like a holiday

In retirement you have a different relationship with time. Holidays are usually time limited you are aware of this while you’re away. The realisation that you are not going back to work is something you can’t prepare for until you are retired.

2. You should retire to something

You have to know what you want to do with yourself and your life. No one can tell you. You would be surprised at how many people don’t know what they want to do when the time comes.

3. Beyond the bucket list

Everyone has a bucket list of things they think they will do in retirement. In reality some of those things you will decide are unimportant. The rest you will complete in six months. After you’ve finished your bucket list, you have to figure what to do next

4. Comfortable doing your own thing

There is also the problem of loneliness because everyone else could still be working. You have to be comfortable with being alone if you retire before everyone else. You should actively plan things to do with other people.

5. Relationships with ex-colleagues

You will lose touch with many of the people you worked with and talked to every day. If you’ve changed job frequently throughout your career, you may have experienced this already. It may need more work to maintain any good friendships that came easily when in the office.

6. Retirement doesn’t cost as much as you thought

Before you retire, you should track your expenses and estimate future expenses with a spreadsheet or app (ask us about our expenditure calculators!) – then track everything for 3–4 months. Expenses can range from daily, to annual, to the dreaded “emergency”.

7. Learn to live within your means and enjoy it without going out too far.

Retirement can have an enjoyable hedonistic upside, however the image of new cars and exotic holidays can only be achieved if there are the funds there to do it. Without income from work, your pension needs to fund the rest of your life – so make sure it can last first before getting the brochures out!

8. Your pace of life will slow down. Learn to accept it and relax a little.

Without work, you have “claimed back” anywhere between 30-60 hours of your life – per week! No commuting or deadlines and squeezing everything else into the weekend. You can still be occupied and productive, however you now have seven days a week to do what you need to do. Relax and take in the slower pace.

9. Accept your new life. Don’t regret your past life.

Don’t be embarrassed to tell others you are retired and that you are enjoying it (if you are). There’s no guilt to be had and most likely you’ve done enough years in the working world!

10. Understand that financial independence and retirement are different concepts

If you are financially independent then you are totally in control of what you want to do each day. If you want to continue “working” and collect a paycheque then that is up to you. Genuine enthusiasm and passion for the work you do should be embraced.

11. BONUS – Consider volunteering

If you are really looking for something to do then volunteering can take many forms. There are huge number of opportunities out there. Research says that doing something for others is a powerful way to increase your own happiness.

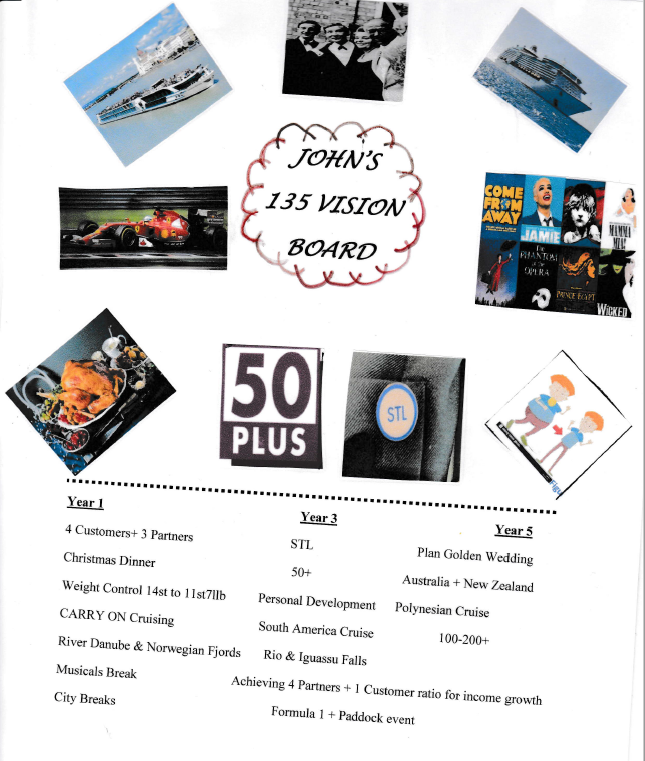

12. DOUBLE BONUS – Create a mood board

One of our clients even made his own mood board that we felt we just had to share! John identified everything he wanted to do – ranging from holidays to personal health goals – and outlined a 5-year plan. He could then budget and know the years in which spending would increase for the big outlays, interlaced with goals that weren’t finance focused, like cooking a Christmas dinner! Check out his plan below – how does yours compare?

If you have any questions regarding retirement planning and support, please don’t hesitate to talk to one of our advisers by emailing info@beckettsfs.co.uk